40+ calculating mortgage interest deduction

Determining factors may be but are not limited to loan amount and term. Homeowners who bought houses before.

4 Ways To Calculate Mortgage Interest Wikihow

Web Calculating excess home mortgage interest deductions Entering excess home mortgage interest into Schedule A Understanding the Excess Mortgage.

. Apply Get Pre-Approved Today. Easily Compare Mortgage Rates and Find a Great Lender. Ad Compare the Best Home Loans for March 2023.

Web if it had been a more expensive loan say 50000 interest you would be able to go above the caped value from the 1st loan. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on.

Web Currently the home mortgage interest deduction. Web To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the Internal. Web This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes.

However higher limitations 1 million 500000 if. Web Understanding Excess Home Mortgage Interest for Individual federal Schedule A in ProConnect. If you are single or married and.

Get Instantly Matched With Your Ideal Mortgage Lender. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Honed in and noticed it was only calculating about 40 of my mortgage interest had similar situation where. Lock Your Rate Today.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. This article will help you apply home mortgage interest. Save Real Money Today.

First Time Home Buyer. Web Tax deductions are not the same as credits. How It Works in 2022 The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to. Therefore if your taxable. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms.

At the end of the year you deduct the interest from your taxable income reducing your overall tax burden. Web Mortgage-Interest Deduction. Publication 936 explains the general rules for.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web This form will state exactly how much you paid in interest and mortgage points over the course of the year and act as proof that youre entitled to receive a.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. 20000500003333 23000 if. Web Most homeowners can deduct all of their mortgage interest.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

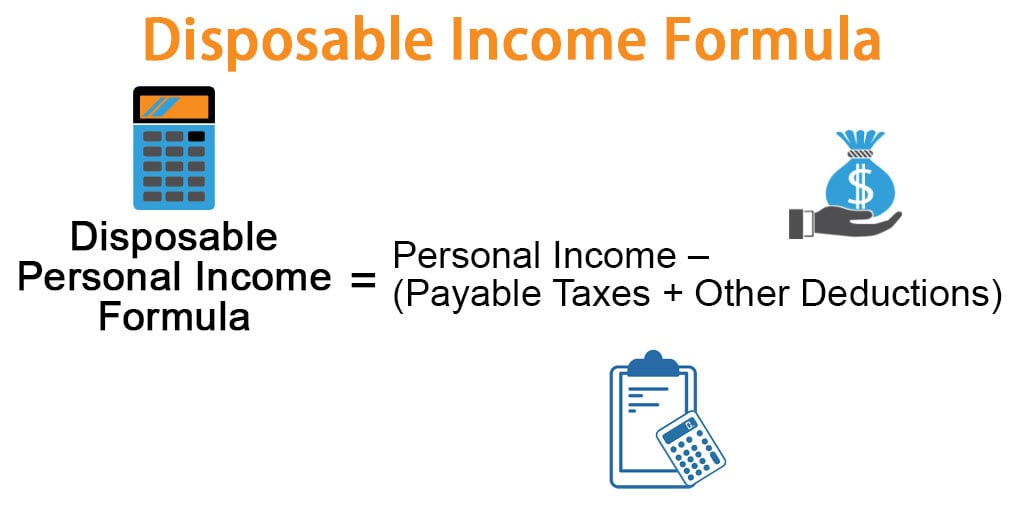

Disposable Income Formula Examples With Excel Template

Mortgage Payment Tax Calculator Deduction Calculator

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The Mortgage Center Financial Calculators Com

Maximising Property Tax Deductions For The 2020 21

What Is Playslip Get To Know Its Benefit Format And Examples

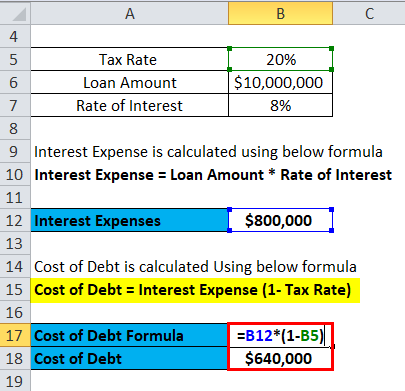

Cost Of Debt Formula How To Calculate It With Examples

Negative Gearing And Depreciation

Compound Interest Formula Calculator Excel Template

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

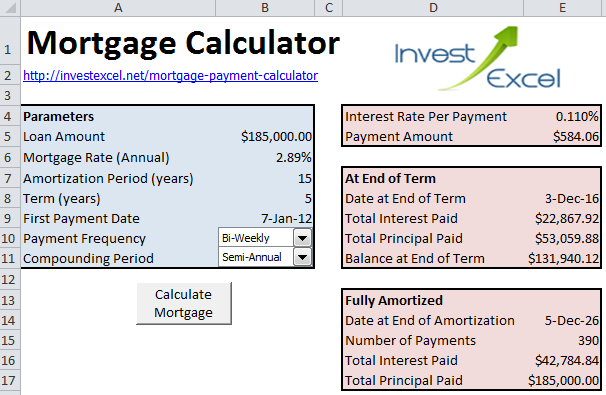

How To Calculate Mortgage Payments In Excel

Maximising Property Tax Deductions For The 2020 21

How Are Mortgage Interest Rates Calculated Quora

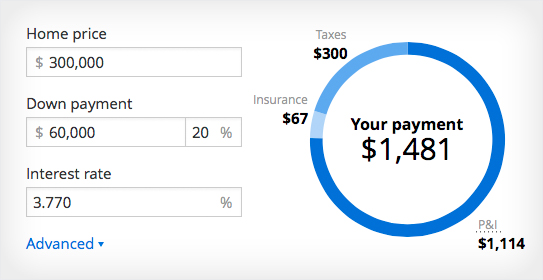

Mortgage Calculator Free House Payment Estimate Zillow